HIC

Homestead

Investment Co-operative

Wednesday Webinars & Building Tours

Join us for an exclusive building tour at the Alberta Block Building, a beautifully restored historic gem on Jasper Avenue. This is your opportunity to explore a unique investment property that blends heritage charm with modern potential.

📍 Location: Alberta Block Building, #202 10526 Jasper Avenue NW, Edmonton

5:00 - 6:30 pm

Tour ends at the award winning Fu’s Repair Shop on the first floor.

Register here

Building Alberta

One Investment at a Time

Join the movement to redefine local investment and create a brighter future for Alberta businesses with Homestead Investment Co-operative.

Invest in the first building in a portfolio of co-operatively owned

Alberta real estate assets.

We’re building a Community Investment Co-operative that will help drive social, business and economic impact in Alberta. Starting with Edmonton, we’re investing in sought-after real estate assets that will help support and grow local businesses and entrepreneurs while building wealth for our investors.

HIC Investment Webinar with Tegan Martin-Drysdale

From the Investors Perspective…

Exciting Things Are Happening - HIC in the News

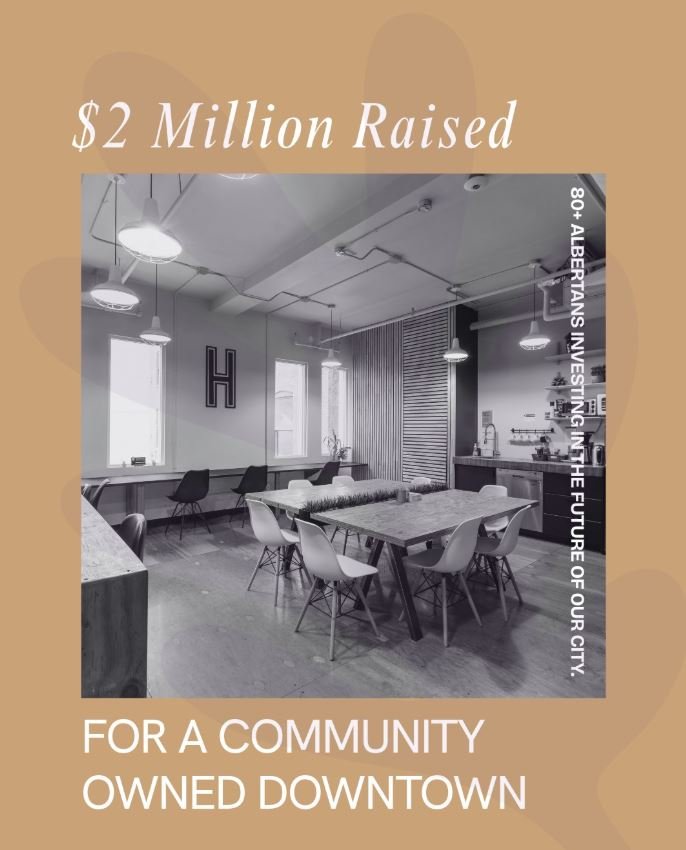

Through the Homestead Investment Co-operative, everyday investors now have the opportunity to own a share of this iconic downtown building and be part of its growth.

We want to thank everyone for their growing support and for joining our mailing list, attending our webinars, and our events. We have been building momentum and are excited by the traction we are getting to purchase the Alberta Block. Our key messaging is resonating with Albertans across the province, as evidenced by the recent Edmonton Journal Article.

About The Building

• Outstanding cultural heritage • Recent deep retrofit • High Value

Your Opportunity

Commercial real estate vacancies in downtown Edmonton are getting harder to find, here's your chance to participate in ownership of commercial real estate in Edmonton!

Projected annual returns of at least 6% as well as long-term gains in the building’s equity.

Performance

A fixture on Jasper Avenue for finance, music, arts, and now for entrepreneurs

Currently leased with high occupancy

Add additional revenue by developing the rooftop patio and additional spaces

Tenant rent revenue & growing businesses

Ticketing for premium professional development events

Space rentals on future amenities

Future real estate acquisitions

How Will We Build Revenue?

A $9.0M Deal

RRSP/TFSA Eligibility through the Canadian Workers Cooperative Federation.

Early commitment benefits!

I’ve heard enough, let’s invest!

Class B minimum subscription: $10,000

Class C minimum subscription: $100,000

I’m interested in learning more

Your role as an investor:

● Join our mentor community and help the next generation of leaders, creators, and innovators thrive (plus get first look at investment opportunities)

● Refer like-minded potential tenants, mentors, and investors

● Participate in one member one vote general meetings to make key strategic decisions with the co-op community

Founders, Incentives & Governance

• The Founders are serving as the initial board • They have fronted all costs to date and have committed to more share purchases • Founders and directors will not receive management fees for putting the deal together.

Build your wealth

Our initial investment in the Alberta Block building on Jasper Avenue is forecasted to provide solid returns.

Support entrepreneurs

One of the key drivers of the Homestead Investment Co-operative is to provide spaces that support entrepreneurs and help them grow their businesses with access to expertise and peer advice.

Own a piece of Edmonton’s mainstreet

Jasper Avenue is the nerve-centre of downtown Edmonton, and owning a piece of it right in the city's core will not only help you build wealth, but build our city and support entrepreneurs.

To learn more, add your email to our mailing list and get the pitch deck.

Who's Behind This?

People committed to making Edmonton thrive through unleashing the ingenuity of this place and its people.

These are the founding directors:

Tegan Martin-Drysdale

Founder of the original Homestead business, sustainable real estate developer and operator of a number of social impact-focused for-profit companies.

Tegan has 24 years of experience in structural engineering and project management for mixed use, commercial and residential projects. Before forming RedBrick Real Estate Services in 2012, Tegan was a project manager with ProCura Real Estate Services and worked with Read Jones Christofferson as a Structural Engineer. Over the past 12 years, Tegan has built residential, mixed use commercial, retail, and office buildings in Edmonton and the surrounding area, and is now also working with First Nations in Northern Alberta to develop housing solutions in and outside their communities. Tegan co-founded Homestead Coworking in 2015 and established a new co-working space in Edmonton’s downtown in the Alberta Block building. This is where RedBrick’s offices are located, as well as where Tegan continues to contribute to the business and entrepreneurial community in Alberta.

In 2010, Avenue Magazine named Tegan one of its Top 40 Under 40. She founded the Infill Development in Edmonton Association in 2013 to promote and advocate for high quality infill development in Edmonton. Tegan also Co-Chaired past City of Edmonton Initiatives such as the NextGen Committee and Make Something Edmonton.

Don Iveson

Two-term former Mayor of Edmonton and now Principal of Civic Good, a consultancy delivering social impact, governance and environmental leadership guidance for companies and communities.

Don founded Civic Good in December of 2021, a practice that provides strategic advice on climate, housing, civic innovation and complex governance issues. As Principal, he is currently engaged primarily with Co-operators as Executive Advisor, Climate Investing & Community Resilience, where he supports the CEO and key executives in advancing initiatives that will support climate adaptation projects and climate-resilient infrastructure in communities across the country. He also advised governments, NGOs and startups in areas ranging from modular housing to social impact assessment.

He was recently Federally appointed Chair of the Canadian Mortgage and Housing Corporation – the nation’s sixth largest financial institution. Don brings wide-ranging governance experience to the board, including eight years as Mayor of Edmonton.

Our board is growing

New board members that have joined our movement:

-

With over two decades of experience in government, public relations, and community engagement, Marilyn has built a career at the intersection of politics, policy, and advocacy. Serving as an Executive Assistant to both the Mayor of Edmonton and multiple City Councillors, she has managed high-level administrative operations, stakeholder relations, and policy development. Her expertise includes coordinating strategic outreach, overseeing complex scheduling, and providing research support on civic issues.

Beyond municipal government, Marilyn has played a key role in provincial and federal political campaigns, leading leader’s tour logistics and event coordination. Her background also includes community outreach, volunteer coordination, and issue management with the Alberta Legislature. With a strong foundation in research, public engagement, and urban planning, Marilyn excels in fostering relationships between government, community leaders, and the public.

-

Jacquelyn Cardinal's expertise in community-driven investment and Indigenous entrepreneurship brings vital perspective to HIC.

As co-founder of Naheyawin and former Impact Analyst at Raven Indigenous Capital Partners, she has a proven track record of integrating diverse worldviews into successful business models.

Jacquelyn's governance experience, including her roles with the Edmonton Community Foundation and Edmonton Unlimited, informs her approach to ethical, community-focused investment strategies. Her insights have been sought by the Standing Senate of Canada Committee on Aboriginal Peoples, underscoring her ability to bridge Indigenous and non-Indigenous economic interests.

Recognized as one of Avenue Magazine's Top 40 Under 40 and with the UN Women SHEInnovator Award, Jacquelyn brings innovative leadership to HIC's mission of fostering high-impact local investments with strong social and financial returns.

-

Kyla Kazeil is an Edmonton-based Entrepreneur with 19 years experience. Currently Kyla is the co-owner and director of 4 corporations (The Bamboo Ballroom, The Common, Fu’s Repair Shop, Dolly’s Cocktails) with yearly gross combined revenue of $5.85 million and more than 150 employees.

Her passion is developing world-class, award-winning establishments which are equitable and inclusive for all.

She excels in communications, events, team development particularly with female empowerment, problem solving, efficiency, time management, and interpersonal skills. Currently she sits on two additional boards; as the Communications chair at Strathcona Nursery School and on the board for the CCMA Legacy Committee.

-

Heather has been a life-long entrepreneur, having started two businesses in the Fairview area while operating and expanding a third-generation family farm and raising a family of four children.

The first was a retail store which was sold to the current owner after operating it for ten years. Along with her husband, she was also an integral part of building an international forage seed processing and marketing business, which has been constantly growing during the past four decades.

Heather is currently the CEO and lead Forage Seed Marketer for Golden Acre Seeds, their well-respected international wholesale and retail business.

On the farming side, their now fourth-generation family farm has grown to encompass over 30,000 acres, growing high-quality grains and oilseeds, along with many types of forage seeds.

Heather has also served more than 30 years on multiple boards, including positions as Chair of the national Forage Seed Canada board, as well as Treasurer of Peace Region Forage Seed Association and Organic Alberta. She was an inaugural board member of the PRFSA, and also served on numerous local boards. She has recently been reappointed to the board of Northwestern Polytechnic for an additional three-year term.

She has been involved in community sports, coaching senior high school volleyball for many years. A personal achievement was earning the honour of Valedictorian for her high school, and always achieving excellence in all her endeavours.

Heather brings much knowledge, energy, and enthusiasm as well as an abundance of entrepreneurial experience to HIC.

Interview with Don

Interview with Tegan

Interview with Jacquelyn

Interview with Heather

Want talk to someone at Homestead Investment Co-operative?

Book an in-person tour.

Frequently Answered Questions

-

We wanted to create a low barrier investment model for Albertans who want to keep their money local, invest in commercial and mixed use real estate, and support the growth of local businesses and entrepreneurs in Alberta. We are building a community at the same time that we are building a solid real estate portfolio across Alberta. In 10 or 20 years, we are excited to see what we will have accomplished with this community of investors, entrepreneurs, builders, doers and innovators.

-

There is an opportunity to invest in downtown Edmonton right now with high numbers of new residents, commercial vacancies trending downwards, and interest rates dropping. The opportunity to purchase the Alberta Block arose, and we realized it was the perfect first project to launch our investment model. It is situated in the centre of our province, in our capital city, in the heart of the downtown core on Jasper Avenue. Plus the historic original name of the building being "Alberta Block" tells us so much about what the building represents for our province. It has stood for over 115 years as a mainstay in the centre of our province, as the home to many businesses, entrepreneurs, innovators, doers, creatives and musicians. Our plan is to continue its story and continue making it a hub for Albertans who build things from the ground up.

-

The building has a 96% occupancy and long term tenancies. The Offering Memorandum provides the listing of the leases in place and terms.

-

The building is a historic building (built in 1909) but is not a “heritage” site with restrictions from government based on financial support. The building has not received any designation that restricts its use or development and has recently undergone a major update and retrofit.

-

If you need to sell your shares, there are pathways to doing so after 4 months from the purchase date. The projected 6% dividends do not include any increase in property value over that 10 year period, so it is difficult to compare to a GIC. Also when you invest in a GIC, how is that money being invested? In what companies and industries? You don’t have control over exactly where the bank invests those funds, and in what locations. Your money is no longer in your local economy or community and you don’t get to vote or have any influence on where it is invested. With this opportunity you know exactly where your funds are invested and you get a say.

-

Alberta wide entrepreneurs, business owners, investors, doers, builders, and innovators. People that get things done and solve problems instead of waiting for others to solve them.

-

With a REIT you don’t get to vote annually and have a say or an opportunity to be on the Board of Directors. With a REIT you don’t usually know the exact details of where your money is invested and in which properties. You also don’t get an opportunity to get added perks such as access to the building spaces and events, or benefits for being an early investor.

-

Yes both land and building.

-

Currently Tegan Martin-Drysdale, who has been involved in the building since 2013 during the major energy and interior retrofit, manages the building and its operations. As a result of the energy retrofit, we have been able to keep our operational and maintenance costs low for our tenants compared to other office buildings in Edmonton, which helps keep our leases competitive.

-

We have leases that range from 5 yrs to 10 yr leases, with renewal dates between 2026 and 2029.

-

We are looking for longer term investors that are interested in an investment timeframe of at least 5 years. When an investor chooses to exit, they have the option of selling their shares to other existing shareholders, new investors, or back to the co-operative investment group as a whole. The seller will receive the value of their shares plus any dividends owed.

Still have questions? Send an email to Tegan